Bollinger Bands RSI MA Indicator ⋆ Top MT4 Indicators {mq4 & ex4} ⋆

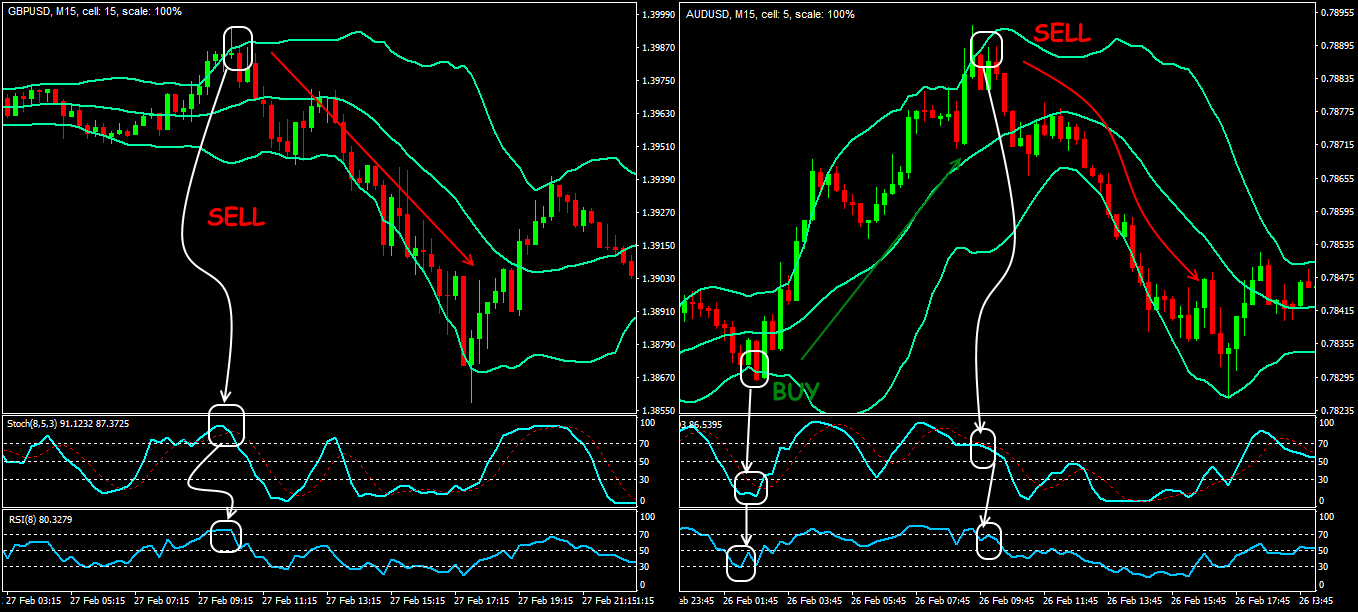

The Bollinger Bands RSI is a magical combo to time entries with your favorite currency pair. After examining the picture, it may seem wise to buy every time the price hits the lower band. Or, on the other hand, sell every time the price hits the upper band. This can technically work but is a risky way of trading.

Bollinger Bands indicator trend for active and rational

Bollinger Band®: A Bollinger Band®, developed by famous technical trader John Bollinger , is plotted two standard deviations away from a simple moving average.

Bollinger Bands & RSI Divergence Trading Strategy with NO STOP LOSS Scalping Strategy YouTube

The RSI with Bollinger Bands indicator combines the strengths of two popular technical analysis tools to provide traders with a powerful means of identifying potential market extremes. By incorporating this indicator into your trading strategy, you can better understand the current market environment and make more informed decisions.

Bollinger bands rsi

Bollinger Bands are a technical analysis tool developed by John Bollinger in the 1980s for trading stocks. The bands comprise a volatility indicator that measures the relative high or low of a security's price about previous trades. Volatility is measured using standard deviation, which changes with increases or decreases in volatility.

Bollinger bands Normalized RSI Indicators ProRealTime

Buy conditions: If the widening variable remain within the Bollinger and the widening of the bands is less than a pre-specified margin as well as the RSI reaching the oversold zone, then we.

Secret Forex Trading Strategies Roky Bollinger Bands Urban Creeks Council Creeks for people

Calculation of RSI. The Relative Strength Index can be calculated by the following formula: Relative Strength or RS is computed as the average gain divided by the average loss during a specified period, usually 14 days (as suggested by Welles Wilder). The range of the RSI is 0 to 100.

Bollinger Bands with fast RSI Rsi, Technical analysis charts, Stock market chart

RSI and Bollinger Bands Strategy. Another way to trade with the Bollinger Bands is to combine it with the RSI. Again, traders have different ways of going about this, but we will keep it simple. Remember that the RSI is a leading momentum indicator while the Bollinger Bands is a lagging indicator, which means that combining them helps us spot.

Rsi vs bollinger bands 4xone

A Bollinger Band trading strategy can signal entry and exit positions based on band expansion or contraction as well as price action behaviour with respect to the bands. The tightening of the bands is called a Bollinger Squeeze and signals an impending breakout. This strategy works well when the market is moving sideways.

Excellent ! Bollinger Bands Trading Strategy You Must Aware of This

Indicator Description: The "Bollinger RSI Bands" is an advanced technical analysis tool designed to empower traders with comprehensive insights into market trends, reversals, and overbought/oversold conditions. This multifaceted indicator combines the unique features of candle coloration and Bollinger Bands with the Relative Strength Index (RSI), making it an indispensable tool for traders.

CCI with Bollinger Bands Indicator • Free MT4 Indicators [MQ4 & EX4] Download • TopTrading

RSI Upper Band. Can toggle the visibility of the Upper Band as well as sets the boundary, on the scale of 1-100, for the Upper Band (70 is the default). The color, line thickness and line style can also be determined.. Only applicable when Bollinger Bands are selected as the MA Type in the Inputs section, otherwise the background fill will.

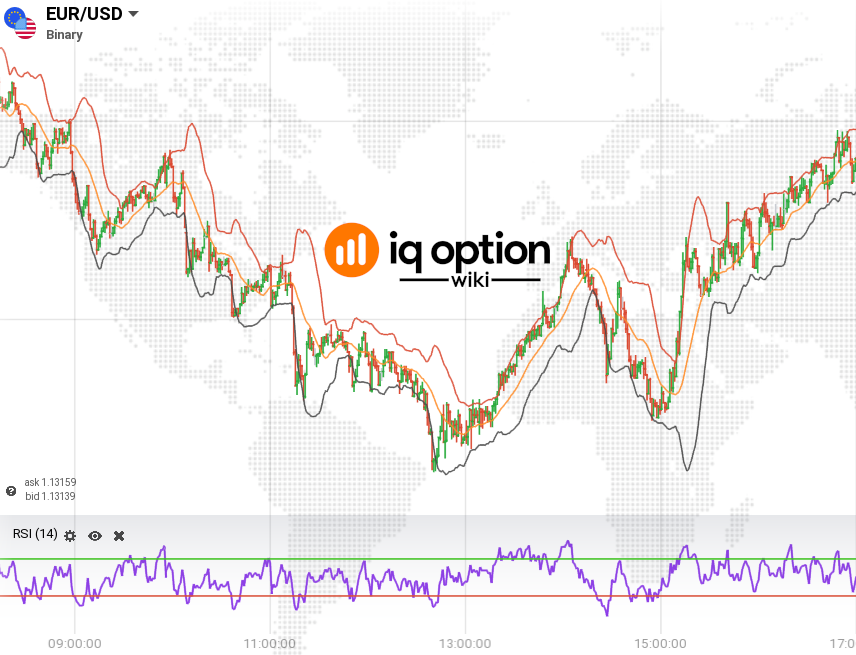

Learn How to Trade Bollinger Band and RSI strategy on IQ Option. Benefit from the power of 2

RSI Bollinger Bands. sndwav. Bollinger Bands (BB) Relative Strength Index (RSI) 593. 1. This RSI indicator has a Bollinger Bands indicator around it, and a simple moving average. I still haven't decided yet if the Bollinger Bands should be at 20 (like normal) or at 14 (like the RSI). Experiment with it and have fun :)

What are Bollinger Bands and How to Utilize them for Cryptocurrency Trading Coinalyze Blog

The RSI and Bollinger bands are 2 of the most popular forex trading indicators. You can use them both to spot overbought and oversold market conditions when used individually. They can also be used to sport market trends and breakouts. However, the accuracy of these indicators can be improved when combined together to form the RSI and Bollinger.

RSI with Bollinger Bands TrendSpider Learning Center

The RSI is a momentum oscillator that measures the strength of a security's price action, while Bollinger Bands are a measure of volatility based on moving averages. Our strategy will generate.

Estratégias com Bandas de Bollinger O que é e como funciona? Trading Plan

It is very common to combine Bollinger Bands with another famous indicator, the Relative Strength Index, or RSI, to help confirm a trend's relative strength. The RSI is a momentum indicator that.

Low Risk Forex Strategy With Bollinger Bands And RSI Indicator

This video shows how to use RSI in conjunction with Bollinger Bands as a trading strategy on the timeframe of your choosing. Get access to life-changing priv.

Bollinger Bands, RSI and ADX Trading System Forex Strategies Forex Resources Forex Trading

Bollinger Bands can be applied around the RSI line to assess additional buy and sell signals. When RSI is near an extreme high (~100) or low (~0), and is touching either the high part of the upper band or the low part of the lower band, the RSI line could pull back sharply from the band. Bollinger Band analysis holds that a failure of RSI to.